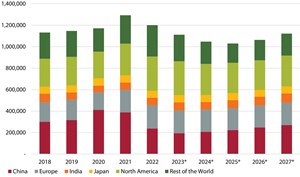

Off-Highway Research’s forecast is for a 7 per cent decline in global sales in 2023. This is a slightly steeper downturn than envisaged a year previously, due to the weakness of the Chinese market. Stripping China out of the equation, the remaining countries of the world will only see a 5 per cent downturn overall.

Off-Highway Research would still classify the 2022-2025 downturn as a soft landing. Only single-digit year-on-year falls in equipment sales are expected, and the volume of machines sold throughout the forecast period should stay above 1 million units per year. Prior to the current up-swing, such a volume was only achieved twice before.

The forecast is based on the premise that infrastructure investment will be strong and that although interest rates are rising, they will only slow down residential construction, rather than push it over a cliff.

However, there are risks to the forecast and they are almost entirely on the downside. Inflation was a serious issue throughout 2022 and although improving, it remained too high in early 2023. Add to that the war in Ukraine, which continues to heighten inflationary pressures worldwide and is therefore also exerting upward pressure on interest rates.

Off-Highway Research’s Global Market Review is available now to all subscribers. Contact [email protected] for more information about our subscription packages. The report can also be bought by non-subscribers here.

|

KHL Media Limited © Off-Highway Research 2026 All right reserved |

About Us Privacy Policy |

Contact Us Terms & Conditions |