Demand has cooled from the record high of 62,300 machines sold last year, when the market was worth US$8.5 billion. However, Off-Highway Research beleives sales will stay at historically high levels this year and over the medium term.

Off-Highway Research managing director, Chris Sleight said, “Similar to most markets around the world, South America saw a very strong rebound in sales in 2021 and 2022. Demand is cooling to more sustainable levels now, but 2023 is still likely to be the second or third highest year on record for construction equipment sales. It is a decade since the market was last at comparable levels.”

The rebound in South American construction equipment sales has been driven by the resurgence of Brazil, which last year accounted for almost 70 per cent of the continent’s equipment market. According to Off-Highway Research’s new Special Report on Brazil, this has been driven by a combination of government investment in infrastructure and strong commodity prices, which have stimulated demand from the mining and agricultural segments alike.

With the economic outlook for South America being both reasonably stable and buoyant, Off-Highway Research expects the equipment market to continue at a high level.

“With the exception of Argentina, where rocketing inflation is a huge brake on growth, we are reasonably up-beat on South America, “ said Sleight. He continued “We see moderate economic growth across the region and stable prices for the next few years, which will be conducive to keeping the equipment market up around 50,000 machines per year.”

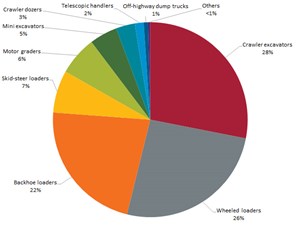

Machine preferences

The most popular machines in South America are backhoe loaders, crawler excavators and wheeled loaders, which all sell in similar numbers and together accounted for more than three quarters of unit sales in 2022. In value terms the wheeled loader and crawler excavator markets were each worth about US$2.1 billion in 2022, while the backhoe loader segment, was worth just over US$1 billion.

The value figure for backhoe loaders is smaller due to the smaller size of the machines compared to crawler excavators and wheeled loaders, but according to Sleight, the volume was still significant. “More backhoe loaders were sold in South America than North America in both 2021 and 2022 – the first time that has ever happened. The backhoe loader is a very important product in that part of the world and South America accounts for about 15% of global demand this type of equipment.”

He continued, “In addition to the most popular products, there are some interesting mid-volume segments in South America. There is very significant demand for motor graders, it is the second largest skid-steer loader market in the world after North America and there is sizeable demand for crawler dozers.”

Off-Highway Research offers a range of data and reports on the construction equipment industry in South America, including its new 220+ page report on Brazil. For more information e-mail [email protected]

|

KHL Media Limited © Off-Highway Research 2026 All right reserved |

About Us Privacy Policy |

Contact Us Terms & Conditions |