The strongest growth in 2022 was seen in the larger markets of Southern Europe – most notably Italy, which saw sales rise an impressive 18 per cent, while Spain’s 17 per cent growth was also well above average. France also performed well with an 8 per cent rise in sales, thanks to broad demand for both heavy and compact equipment. Growth in the UK was more subdued at 4 per cent, but the volume of equipment sold was the highest ever seen. Meanwhile the German market declined 1 per cent, but this must be seen in the context of the extraordinarily high number of machines which have been sold in the country in the last four to five years.

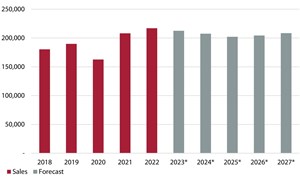

Off-Highway Research’s forecast for Europe is essentially for the market to stabilise at a high level. Although single-digit percentage annual declines in sales are expected for the next three years, the market is forecast to remain above 200,000 units over the medium term. Prior to the current peak, a volume above 200,000 machines sold was only achieved once before for a single year in 2007.

A slowdown in housebuilding due to rising interest rates represents a threat to compact equipment sales. However, Europe’s infrastructure markets are strong, which should stimulate sales of larger earthmoving equipment.

A full discussion on the state of the European construction equipment market and the outlook to 2027 is available to subscribers to Off-Highway Research’s European Service and European Database Service. For more information about Off-Highway Research’s reports and data, contact [email protected]

|

KHL Media Limited © Off-Highway Research 2026 All right reserved |

About Us Privacy Policy |

Contact Us Terms & Conditions |