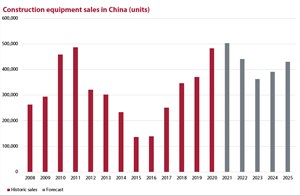

Prior to the pandemic, the Chinese market was expected to decline in 2020 following three years of growth. However, the stimulus spending saw equipment sales surge by just over 30 per cent, to take the total for 2020 to 482,788 machines sold. This includes earthmoving, compact and road building equipment, alongside mobile cranes.

Such high sales had not been seen in China for almost a decade. The last boom of this magnitude was in 2010-11, again as a result of a vast stimulus spending boom – that time in response to the global economic crisis. The number of machines sold last year almost exactly matches the previous peak of 2011. However, with modest growth forecast to follow in 2021, the Chinese market is likely to rise to more than 500,000 unit sales, which would be a new record.

Full details of last year’s boom, split across the 14 construction equipment types covered by Off-Highway Research, are available in the newly updated Chinese Database Service. This includes details of sales and production of each equipment type by OEM and by year. Commentary on the data will be available through the Chinese Annual Review, which will be published in April, and which will be available to subscribers to both the Chinese Service and Chinese Database Service.

Subscribers to the Chinese Database Service can login here. Non-subscribers can contact [email protected] for more details about our reports and subscription packages.

The Chinese market will also be discussed in the forthcoming Off-Highway Global Briefing webinar on 30th March. Click here for more details and to book your place.

|

KHL Media Limited © Off-Highway Research 2026 All right reserved |

About Us Privacy Policy |

Contact Us Terms & Conditions |